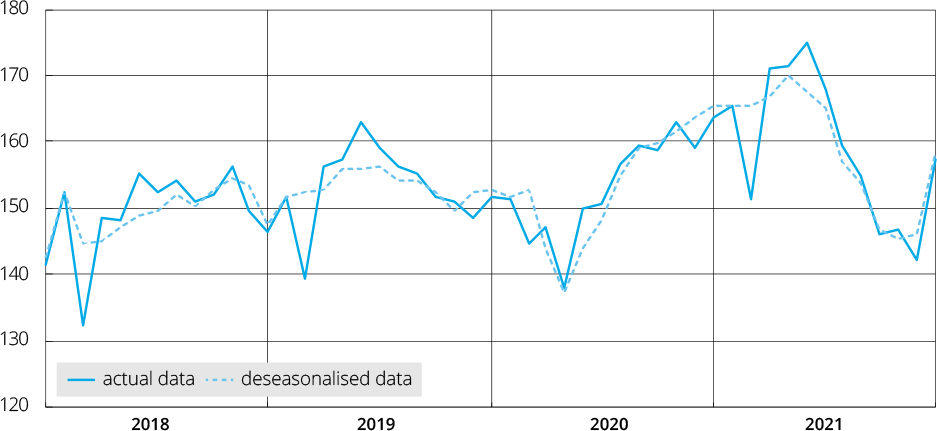

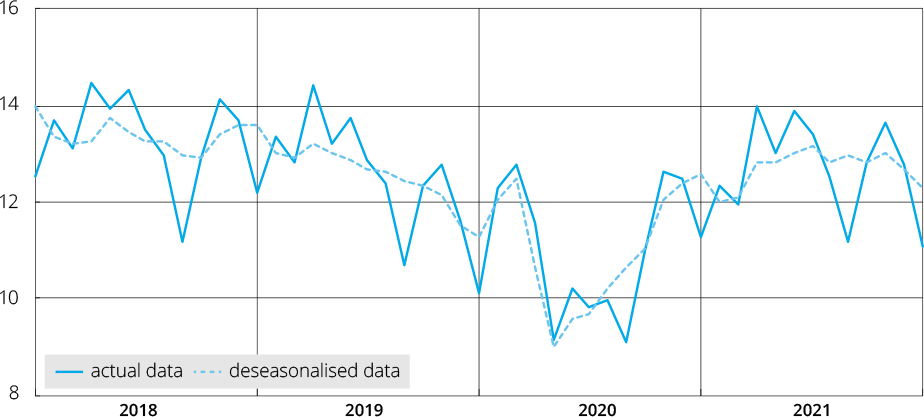

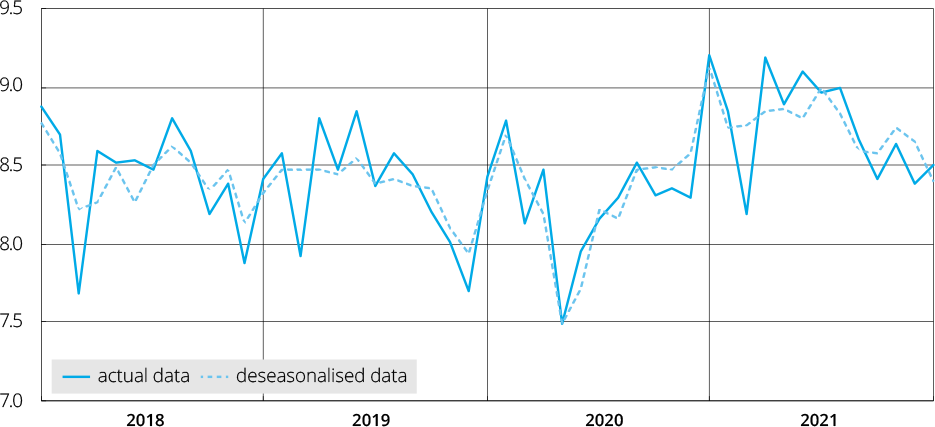

million tonnes

Total 64 reporting countries*

European Union (27)

Russia and Other CIS (4) + Ukraine

*The 64 reporting countries:

Argentina, Australia, Austria, Belgium, Bosnia-Herzegovina, Brazil, Bulgaria, Belarus, Canada, Chile, China, Colombia, Croatia, Cuba, Czechia, Ecuador, Egypt, El Salvador, Finland, France, Germany, Greece, Guatemala, Hungary, India, Iran, Italy, Japan, Kazakhstan, Libya, Luxembourg, Macedonia, Mexico, Moldova, Netherlands, New Zealand, Norway, Pakistan, Paraguay, Peru, Poland, Portugal, Qatar, Romania, Russia, Saudi Arabia, Serbia, Slovakia, Slovenia, South Africa, South Korea, Spain, Sweden, Taiwan, China, Thailand, Turkey, Ukraine, United Arab Emirates, United Kingdom, United States, Uruguay, Uzbekistan, Venezuela, and Vietnam.

In 2021, these 64 countries accounted for approximately 98% of world crude steel production.