Steel is everywhere in our lives and fundamental to a sustainable future.

Whether it is future energy and transport systems, protection from the impacts of natural disasters, climate-resilient infrastructure and buildings, or low-carbon manufacturing and agriculture, steel is at the heart of delivering low-carbon solutions and mitigating the effects of climate change.

Steel steers transformation

Carbon plays two crucial roles in steelmaking: acting as a reducing agent to remove oxygen and other impurities from iron ore to produce iron, and serving as an integral component of steel, created by combining iron with carbon and small amounts of other elements3.

Due to carbon’s key roles in steelmaking, the production of steel remains a carbon and energy intensive activity. Nonetheless, the steel industry is committed to continuing to reduce the carbon footprint from its operations4 and fully supports the aims of the Paris Agreement.

Once made, steel is 100% and infinitely recyclable without any loss of properties.

The steel industry is crucial in driving industrial and societal transformation through:

These actions are highlighted throughout this paper with the following icons:

Steel Industry

Governments

Value Chain

Academia

Keeping track of our emissions

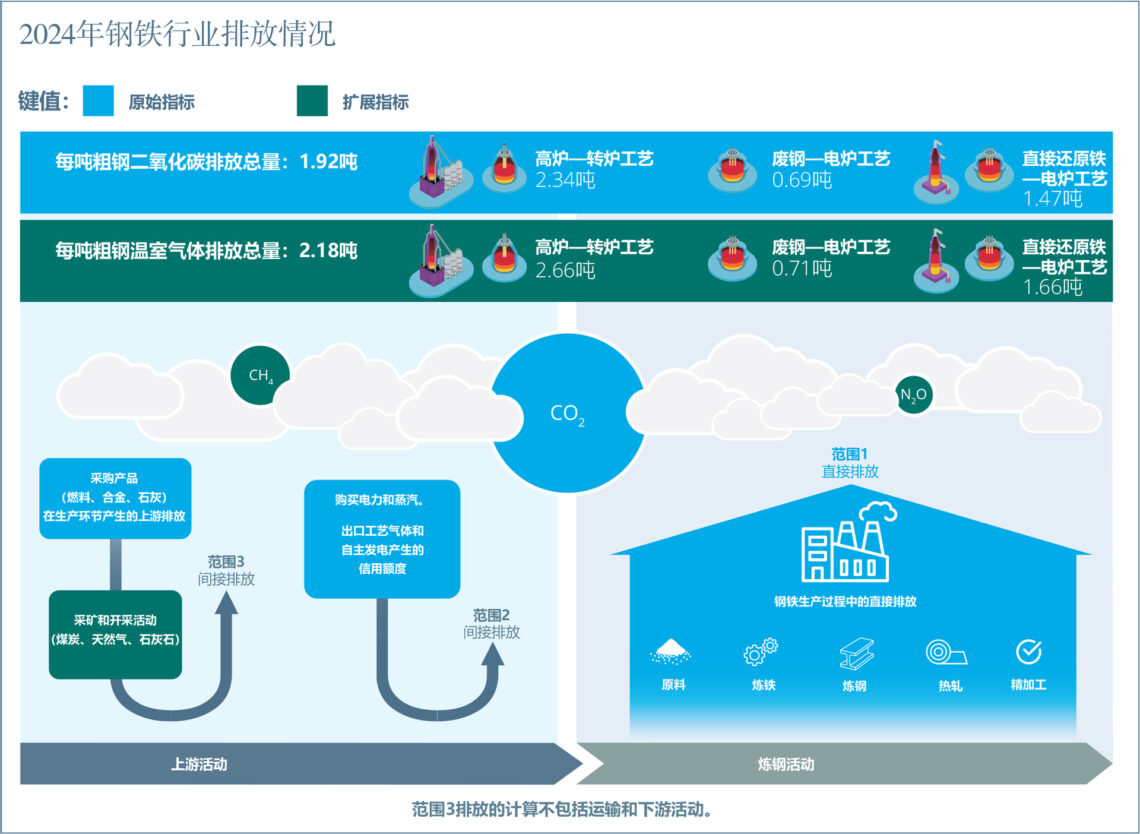

| Ore-based steelmaking produces iron from ore, either in a blast furnace (BF), using coal, or in a direct reduced iron (DRI) furnace, in most cases using natural gas resulting in a lower carbon footprint. The resulting iron is then refined into steel in a basic oxygen furnace (BOF) or an electric arc furnace (EAF) with added scrap.

Scrap-based steelmaking uses electricity to melt scrap in an EAF, often with the addition of pig iron or DRI. The emission profiles of ore-based and scrap-based steelmaking are very different, with the majority of emissions associated with the production of iron from ore. |

Towards a more harmonious standards landscape

Multiple GHG accounting methodologies exist for steel production and products10, and their diversity hinders practical, accurate decision-making and decarbonisation efforts.

For this reason, worldsteel has been working closely with other international organisations and initiatives to develop and launch the Steel Standards Principles (SSP)11, a collaborative effort to harmonise GHG accounting methodologies.

Actions

| Promote the harmonisation of GHG accounting methodologies and reporting standards to enable fair competition. |

| Enhance coverage and transparency around full value chain impacts in our reporting. |

Raising coverage and increasing transparency

Taking action to reduce our emissions:

three main levers

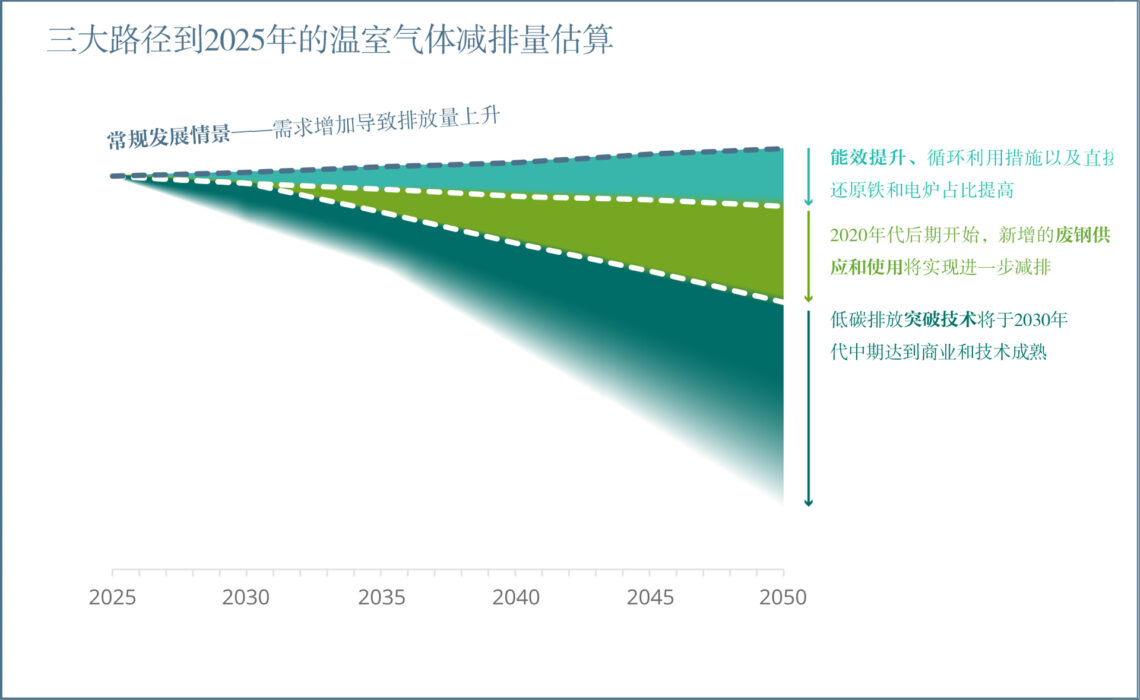

Predicting decarbonisation is uncertain, but three major trends will significantly impact and speed up steel emission reductions in the coming decades.

The three levers in detail

LEVER 1:

Efficiency

The steel industry is resource- and capital-intensive, requiring constant efficiency.

worldsteel’s members, representing 85% of global steel production, invest in and operate increasingly efficient technologies to reduce energy use and GHG emissions16, employing tools such as digitalisation and AI.

Increased use of natural gas-based DRI and EAF, followed by breakthrough technologies, will significantly reduce GHG emissions. However, energy consumption will remain high, and achieving the efficiency levels of legacy technologies will take time.

Actions

| Promote energy and GHG efficiency across the global industry and create forums for pre-competitive knowledge sharing. |

LEVER 2:

Maximise scrap

availability and use

Steel can be recycled indefinitely with no loss of quality, and scrap is a vital process input.

Steel’s magnetic properties make it easy to separate from waste streams, establishing it as the world’s most widely recycled material.

Every tonne of steel scrap used avoids the emission of 1.5 tonnes of CO2 and avoids the consumption of 1.4 tonnes of iron ore, 740 kg of coal and 120 kg of limestone17.

Every steel plant is also a recycling plant: all steel production uses scrap, up to 100% in the EAF and up to 30% in the BF-BOF route.

Some nations have well-established scrap supply chains, meeting most of their steel demand through the use of scrap. However, in countries with expanding steel production, scrap availability remains limited, and supply chains require further development. In these countries, end-of-life scrap availability is projected to grow significantly in the coming decades. Despite the anticipated rise in scrap availability, the ongoing growth in global steel demand indicates that even by 2050, approximately half of steel production will still rely on iron ore.

As governments around the world strive to meet their climate targets, some are considering measures to retain scrap domestically and the potential for diverging national policies is growing. In this context, it is important that policy frameworks support the use of scrap in ways that maximise its contribution to global decarbonisation.

| For more details on scrap availability forecasts, visit worldsteel.org. |

Actions

| Develop technologies to efficiently recycle all collected scrap and maximise its value. | |

| Support the circular economy by adopting a life cycle approach, enhancing collection, and improving sorting of end-of-life scrap. | |

| Ensure scrap policies accelerate, rather than fragment, global decarbonisation. |

LEVER 3:

Breakthrough

technologies

There is no single solution to low-carbon steelmaking. Expanding production with already available technologies such as natural gas-based DRI and EAF will be a significant step forward. However, to achieve deep decarbonisation, a broad portfolio of new technology options will be required. These can be deployed alone or in combination, as local circumstances permit. Our industry is leading research, development, and deployment efforts globally.

The BF remains the predominant technology for reducing iron ore today and is expected to be a key component of the global steel industry for years to come. Modern BFs operate near theoretical efficiency limits but continue to be refined, and many innovative practices are being developed to significantly reduce their carbon footprints.

The next-level blast furnace

- Top gas recycling

- Lower carbon and circular reductants

- Direct and indirect use of hydrogen

- Electrification

- Plasma injection

- Oxyfuel injection

- Digitalisation

When used alone or combined, these practices can transform the BF into an even more efficient technology on the path to low-carbon steelmaking.

However, to achieve drastic reductions, new and transformative approaches are required, and several promising technologies are under development and in the initial stages of application.

These fall into three main categories18:

| Using carbon as a reductant while preventing the emission of fossil CO2 | Substituting carbon with hydrogen (H2) as a reductant, generating water (H2O) rather than CO2 |

Using low-carbon electrical energy through an electrolysis-based process |

| For more details on the next-level blast furnace and breakthrough technologies, visit worldsteel.org |

Actions

| Engage with academia and innovation networks to accelerate applied research and talent development aligned with breakthrough steelmaking. | |

| Acknowledge the need for diverse decarbonisation technologies and reduce regulatory barriers to their implementation. |

Critical enablers: resources, infrastructure, and people

As emerging steel production technologies approach maturity, what must be done now to accelerate widespread adoption?

Energy and cost

Low-carbon steel production is expected to be significantly more expensive than conventional methods. Access to capital and modern financing schemes will be necessary both during the installation of new facilities and to ensure that operating costs are at a viable level. Most low-carbon steelmaking technologies depend—either directly or indirectly—on abundant, reliable supplies of low-carbon energy. In many cases, this energy will be converted to hydrogen, which acts primarily as a reducing agent in novel technologies (e.g., H2 DRI) and, in some cases, as a replacement for fossil fuels in existing processes. Ensuring a consistent and affordable supply of these forms of energy is vital.

worldsteel estimates that the transition will require in capital expenditure (CAPEX):

US$1.2 trillionfor new facilities and adaptation of existing facilities |

+ |

US$2.5 – US$4 trillionin upstream or downstream processes, e.g. energy and infrastructure |

Actions

| Engage with governments to outline low-carbon resourceand finance needs. | |

| Enable access to finance for the transition, for example,through frameworks for sustainable finance. | |

| Partner with steelmakers to de-risk low-carbon technology investment through long-term agreements. |

Ore quality

High iron content in raw materials is vital for efficient low-carbon steel production. Current DRI processes and early hydrogen-based variants need high-grade iron ore (at least 64% Fe), which accounts for less than 20% of global supply. The scale-up of DRI will boost demand for these and, therefore, costs. Investing in technologies like electric smelting furnaces (ESF) can enable the use of BF-grade ores in DRI processes.

Actions

| Work with raw materials suppliers to ensure that evolving technologies can use a broader range of input qualities. |

People

The transition is not solely a technological or economic shift—it also represents a profound workforce, community, and organisational transformation. It creates urgent demand for technical training, reskilling, workforce mobility, and systematic knowledge transfer across the value chain. A just transition-ensuring fair treatment, inclusive dialogue, and shared opportunities—demands proactive collaboration among industry, governments, communities, and labour representatives.

Actions

| The steel industry must play a leading role in drivingthe transition that is just and sustainable for all. | |

| Develop social frameworks that incentivise reskilling. |

Market demand

A strong demand-side signal and clear policy are essential for deploying low-emission technologies at scale, whether new or replacing existing capacity.

Supportive government and private sector demand-side initiatives can accelerate and reinforce demand and bridge the gap between the availability of low-carbon steel and the market readiness to absorb it. These include:

- Strengthen transparency in carbon disclosure with harmonised or interoperable standards, clear certifications, and labelling schemes for embodied emissions in steel production and in steel-using sectors

- Demand side policies including tax incentives linked to carbon intensity, contracts for difference, and public procurement schemes that give preference to low-carbon steel products.

- Effective carbon pricing offers long-term incentives for low carbon production. Policies must support decarbonisation and industrial growth, considering varied pathways and funding needs.

- Steel buyers’ initiatives, such as commitments to purchase a certain percentage of low-carbon steel and off-take agreements.

Actions

| Partner with customers to create market pull for low-carbon steel, including codeveloping standards, procurement models, and product certifications. | |

| Align national policies with international ones to promote free, fair trade and avoid unintended protectionist barriers. |

| Adopt policies that reward proactive efforts without economically disadvantaging companies already invested in efficient steelmaking. | |

| Align national policies with international ones to promote free, fair trade and avoid unintended protectionist barriers. |

Decarbonisation will not follow the same path everywhere

Steelmaking is a truly global industry: steel is produced in all regions of the world under a wide variety of conditions. Each region or country is facing the decarbonisation challenge from a different starting point and with varied access to resources and support.

These regional differences are influenced by many factors, including existing steelmaking capacity. Which low-carbon technologies are viable and when they can be deployed depends on the type, performance, and age of existing assets.

Planned capacity development and target dates for implementation will also impact the technology options that are realistically available. Other aspects, such as availability of energy and raw materials, innovation capability, access to finance, and the policy and regulatory environment, will greatly alter the industry transition pathway in each location.

Today, iron and steel production typically takes place at the same site, however, this might not be the case everywhere in the future. Low-carbon iron could be produced where iron ore and inexpensive low-carbon energy are available and then shipped to another location to produce steel.

From global to regional cost profiles

As the steel industry shifts from globally traded coal to locally priced electricity, regional cost differences will grow.

Affordable electricity will be crucial for global competitiveness.

Actions

| Design policies that suit local contexts while aligning with global decarbonisation goals. |